Venezuela’s boastful referendum results purportedly proving popular support for the annexation of Guyana’s oil-rich Essequibo region may be a rally-round-the-flag move to attract political support, but nevertheless poses serious concerns for commercial operators in the region.

The referendum

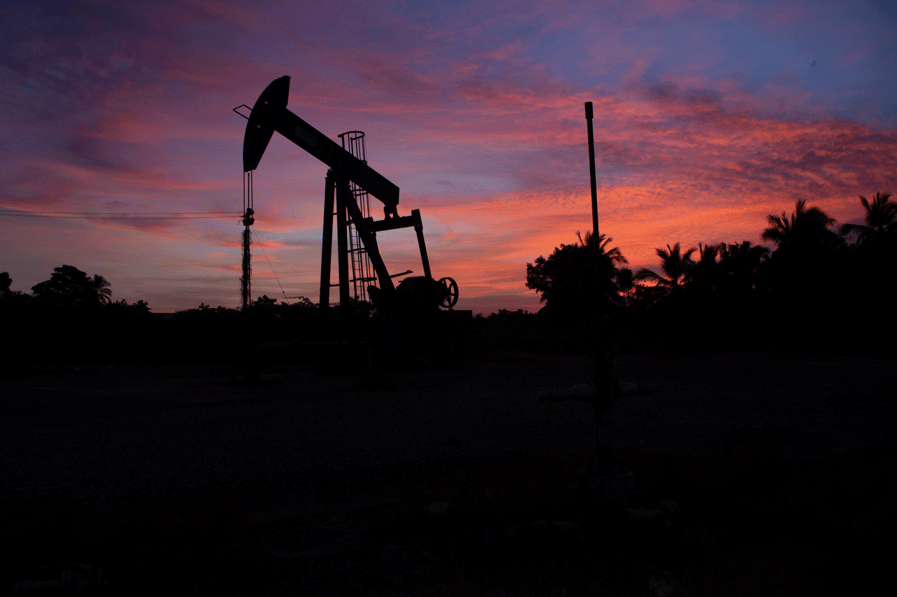

On 5 December, Venezuelan President Nicolás Maduro ordered the issuing of operating licenses for oil, gas and mining activities in Guyana’s disputed Essequibo Province, charging public companies and the state-owned Petróleos de Venezuela oil company to begin exploration in the region. This move follows a national referendum held on 3 December, seeking public approval for the government’s pursuit of sovereignty over the oil- and mineral-rich region. Despite reports of exceptionally limited voter turnout, the National Electoral Council claimed to have received more than 10.5 million votes with a 95 percent approval for establishing a province in Essequibo, rejecting the International Court of Justice’s (ICJ) jurisdiction and pending ruling on the border delineation.

While the territory has been disputed since the 19th century, Maduro’s administration has expressed increased interest in the region since 2015, when significant oil reserves were discovered. The timing of the referendum was likely in part intended to galvanise popular support for the regime and boost Venezuela’s perceived economic prospects ahead of the 2024 elections.

What next?

The ICJ has ordered Venezuela not to act to alter the status quo until it has ruled on the border dispute. However, such a ruling could take years, and according to ICJ President Joan Donoghue, Maduro has already taken steps “[towards establishing] control over and administering the territory.” Venezuelan military officials announced an initiative to construct an airstrip to provide logistical support for developing the Essequibo province. To this end, Maduro has called for the creation of a military unit for the region, to be headquartered in the mining town of Tumeremo in Venezuela’s Bolívar State. Still, direct military confrontation over the matter remains a distant prospect, with Venezuela’s neighbours displaying some consternation over the referendum. Guyana would likely not stand alone in facing Venezuelan aggression.

The regime is nonetheless looking to expedite the exploitation of energy reserves in Essequibo, and has reportedly directed foreign oil companies working under Guyanese concessions in the region to withdraw, claiming operators will have a three-month period to do so once relevant legislation has passed.

Implications for commercial operators

For offshore oil operators in the region, aggressive escalations, particularly efforts by Venezuelan forces to seize commercial infrastructure, would be severely disruptive and drive the potential for the suspension of activities, damage to assets and infrastructure, and safety concerns for personnel. As such, Guyanese authorities are expected to appeal to the UN Security Council with the aim of invoking Articles 41 and 42 of the UN Charter, providing for the authorisation of sanctions and military action to maintain peace. This could provide for international sanctions on the Venezuelan regime and its oil industry, and possibly for the deployment of UN peacekeepers in the region.

Meanwhile, the US is reportedly in negotiations with Venezuela over the country’s failure to meet certain conditions that enabled some US sanctions on the oil industry to be eased in October. The US response to the dispute has so far been muted, and while it will seek to encourage a diplomatic solution, there is a strong possibility of renewed US sanctions should Maduro act in a manner that violates Guyana’s sovereignty, or renege on his commitment to release detained US nationals or ensure fair elections. With Maduro likely lacking the popular support he had intended to mobilise – which may have placed him in a stronger position to succeed in the elections, or bolstered his ability to resist some of the US’s sanctions relief requirements – his next moves will need to be carefully considered. Even bellicose rhetoric or posturing short of an intervention may be enough to trigger snapback sanctions, and Maduro will likely need to demonstrate significant goodwill towards the US to maintain progress made on improving relations and associated economic prospects.

However, given the volatility of the situation, foreign companies exposed to Venezuela’s oil sector and government (or any company accepting licences from Venezuelan authorities to operate in the Essequibo region) remain vulnerable to an elevated threat of US and wider international sanctions. Reinstated sanctions on Venezuela may not necessarily mirror the previous sanctions regime, but nonetheless pose significant regulatory and reputational risks for those exposed to Venezuela’s energy, commodities and finance sectors.